Kicking off with Understanding Lifetime Customer Value, this opening paragraph is designed to captivate and engage the readers, setting the tone american high school hip style that unfolds with each word.

When it comes to business success, understanding the value of loyal customers over time is key. From making informed decisions to refining marketing strategies, knowing your customer’s lifetime worth can make or break a company’s growth. Let’s dive into the world of Lifetime Customer Value and explore its impact on businesses.

Importance of Understanding Lifetime Customer Value

Understanding lifetime customer value is crucial for businesses as it allows them to make informed decisions and develop effective marketing strategies to maximize profitability.

Impact on Decision-Making

- By knowing the customer lifetime value, businesses can allocate resources more efficiently, focusing on retaining high-value customers and increasing their overall lifetime value.

- Understanding customer lifetime value helps in setting appropriate pricing strategies, identifying cross-selling and upselling opportunities, and improving customer service to enhance loyalty.

- It enables businesses to prioritize marketing efforts towards acquiring and retaining customers who are most likely to generate long-term revenue.

Improving Marketing Strategies

- Businesses can use customer lifetime value data to personalize marketing campaigns, targeting specific customer segments with relevant offers and messages.

- By analyzing customer lifetime value, companies can optimize their advertising spend by focusing on channels that bring in high-value customers and deliver a positive return on investment.

- Customer lifetime value metrics can help businesses evaluate the effectiveness of their marketing campaigns and make adjustments to improve overall performance and profitability.

Factors Influencing Lifetime Customer Value

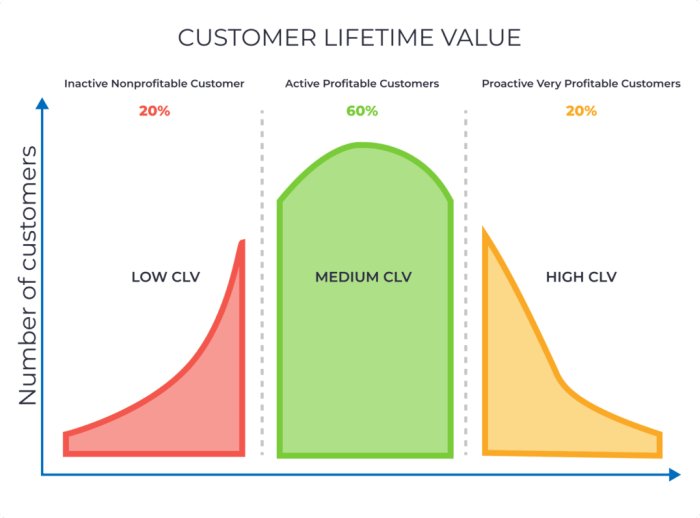

When calculating the lifetime value of a customer, several key factors come into play that can significantly impact the final result. Factors such as customer behavior, retention rates, and average purchase value play a crucial role in determining the overall lifetime value of a customer. Additionally, customer segmentation can also have a profound impact on the analysis of lifetime customer value.

Customer Behavior

Customer behavior is a critical factor in determining lifetime customer value. Understanding how customers interact with your products or services, their buying habits, preferences, and loyalty can help predict their future purchasing patterns. By analyzing customer behavior, businesses can tailor their marketing strategies to increase customer retention and maximize lifetime value.

Retention Rates

Retention rates refer to the percentage of customers who continue to purchase from a company over a specific period. Higher retention rates typically lead to increased lifetime customer value as loyal customers tend to make more frequent purchases and are more likely to engage in upselling or cross-selling opportunities. Improving retention rates through excellent customer service and personalized experiences can positively impact the overall lifetime value of customers.

Average Purchase Value

The average purchase value represents the average amount a customer spends on each transaction. By increasing the average purchase value, businesses can boost their lifetime customer value. Encouraging customers to make larger purchases, offering bundles or discounts, and providing incentives for repeat purchases can all contribute to increasing the average purchase value and ultimately the lifetime value of customers.

Customer Segmentation

Customer segmentation involves dividing customers into distinct groups based on specific characteristics such as demographics, behavior, or purchasing history. By segmenting customers, businesses can target their marketing efforts more effectively, tailor their products or services to meet the needs of different customer groups, and enhance customer satisfaction. This targeted approach can lead to higher customer retention rates and increased lifetime customer value.

Calculating Lifetime Customer Value: Understanding Lifetime Customer Value

To determine the Lifetime Customer Value (LCV) of a customer, various methods can be used. These methods help businesses understand the long-term worth of a customer and make informed decisions regarding marketing strategies and customer relationships.

Different Methods for Calculating Lifetime Customer Value

- Historical CLV Calculation: This traditional method involves analyzing past customer data, such as purchase history, average order value, and retention rates, to estimate future revenue.

- Predictive Analytics: Modern approaches utilize advanced analytics and machine learning algorithms to predict future customer behavior and lifetime value based on current data.

- Cohort Analysis: This method groups customers based on similar characteristics or behaviors to analyze their lifetime value trends over time.

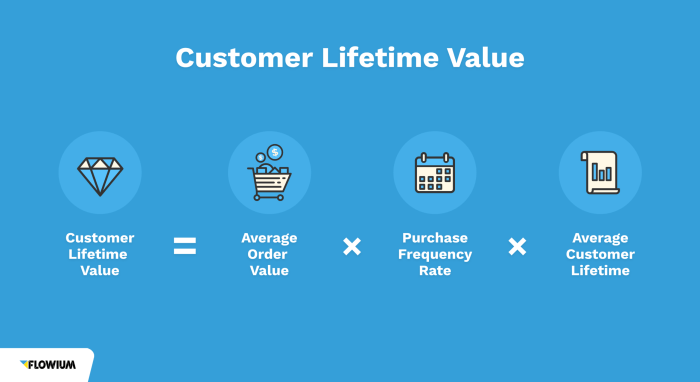

Step-by-Step Guide on How to Calculate Customer Lifetime Value

- Identify the time period: Determine the time frame you want to analyze, whether it’s monthly, quarterly, or annually.

- Calculate average purchase value: Divide total revenue by the number of purchases made during the chosen time period.

- Calculate average customer lifespan: Determine how long, on average, a customer continues to purchase from your business.

- Calculate customer lifetime value: Multiply the average purchase value by the average customer lifespan to get the CLV.

Comparison of Traditional Methods with Modern Approaches

- Traditional methods rely on historical data and assumptions, which may not always reflect current market trends accurately.

- Modern approaches leverage real-time data and predictive analytics to provide more accurate and dynamic customer lifetime value estimates.

- Traditional methods may be simpler and more cost-effective for smaller businesses, while modern approaches require more sophisticated tools and expertise.

Strategies to Increase Lifetime Customer Value

Increasing customer lifetime value is crucial for businesses to thrive in the long term. By implementing effective strategies, companies can enhance customer loyalty and drive repeat purchases, ultimately boosting their revenue.

Role of Customer Loyalty Programs, Understanding Lifetime Customer Value

Customer loyalty programs play a significant role in increasing lifetime customer value. These programs incentivize customers to make repeat purchases by offering rewards, discounts, or exclusive deals. By nurturing customer loyalty, businesses can ensure a steady stream of revenue from existing customers.

- Implement a points-based system where customers earn points for every purchase, which can be redeemed for discounts or free products.

- Offer exclusive perks to loyal customers, such as early access to new products, special events, or personalized recommendations.

- Create tiered loyalty programs that reward customers based on their level of engagement and spending, encouraging them to reach higher tiers for better rewards.

Examples of Successful Companies

Several companies have effectively increased their customer lifetime value through innovative strategies and customer-centric approaches.

Amazon Prime is a prime example of a successful loyalty program that has significantly increased customer lifetime value. By offering fast shipping, exclusive deals, and access to streaming services, Amazon has cultivated a loyal customer base that continues to spend more on the platform.

Starbucks’ rewards program is another success story, where customers earn points for every purchase and receive free drinks or food items after reaching certain milestones. This has incentivized customers to visit Starbucks more frequently and spend more per visit, driving up their lifetime value.