Yo, diving into insurance policies, we’re breaking down the different types, why they’re crucial, what to consider when choosing, and the nitty-gritty of the claims process. Get ready to level up your insurance game!

Types of Insurance Policies

Insurance policies come in various types to cater to different needs and situations. Here are some common types of insurance policies available in the market:

Life Insurance

Life insurance provides financial protection to your loved ones in case of your untimely demise. It typically pays out a lump sum amount to the beneficiaries. There are different types of life insurance policies such as term life, whole life, and universal life insurance.

Health Insurance

Health insurance covers medical expenses and provides financial assistance for healthcare services. It can include coverage for doctor visits, hospital stays, prescription medications, and other medical treatments. Health insurance can be obtained through employers, government programs, or private insurance companies.

Auto Insurance

Auto insurance protects you against financial losses in case of accidents, theft, or damage to your vehicle. It typically includes coverage for liability, collision, comprehensive, and uninsured/underinsured motorist protection. Auto insurance is mandatory in most states and is essential for every vehicle owner.

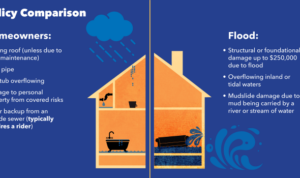

Home Insurance

Home insurance safeguards your home and personal belongings from unexpected events like fire, theft, vandalism, or natural disasters. It covers the structure of your home, personal belongings, liability protection, and additional living expenses in case of temporary relocation. Home insurance is crucial for homeowners to protect their investment.

Importance of Insurance Policies

Insurance policies are crucial for both individuals and businesses as they provide a safety net in times of unexpected events. Whether it’s a medical emergency, a natural disaster, or a liability claim, having insurance can protect you from financial ruin and provide peace of mind.

Financial Protection

Insurance policies offer financial security by covering the costs associated with various risks. For example, health insurance can help offset the high expenses of medical treatments, while property insurance can protect your home or business from damage caused by fire, theft, or other unforeseen events.

Peace of Mind

Knowing that you are covered by insurance can bring a sense of relief and peace of mind, allowing you to focus on other aspects of your life or business without constantly worrying about what might happen in the future. This mental security is invaluable and can help reduce stress and anxiety in uncertain times.

Real-Life Scenarios

Consider a scenario where a homeowner’s insurance policy helps rebuild a house after a devastating fire, or a business liability insurance policy covers legal fees in a lawsuit. These real-life examples demonstrate the tangible benefits of having insurance and how it can make a significant difference when facing adversity.

Risk Management, Insurance policies

Insurance policies also play a vital role in risk management by spreading the financial burden of potential losses across a larger pool of policyholders. This collective approach ensures that individuals and businesses are not left to bear the full brunt of unexpected costs on their own, making insurance a fundamental tool for financial planning and protection.

Factors to Consider When Choosing Insurance Policies

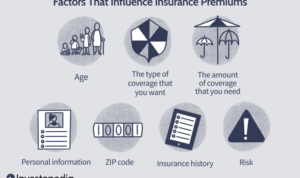

When choosing insurance policies, individuals should take into account various factors to ensure they are adequately protected in case of unforeseen events. Personal circumstances, risk tolerance, coverage, premiums, and terms all play a crucial role in making the right decision.

Personal Circumstances and Risk Tolerance

Insurance needs vary depending on an individual’s personal circumstances such as age, health status, marital status, dependents, and financial obligations. Understanding your risk tolerance is essential in determining the level of coverage needed to protect against potential risks.

- Consider your current financial situation and future goals when deciding on the amount of coverage needed.

- Assess your risk tolerance to determine if you prefer higher premiums for comprehensive coverage or lower premiums with higher deductibles.

- Take into account any dependents or beneficiaries who rely on your income when selecting the appropriate policy.

Comparison of Coverage, Premiums, and Terms

When comparing insurance policies, it is crucial to evaluate the coverage, premiums, and terms to ensure you are getting the best value for your money. Different policies may offer varying levels of protection, costs, and conditions.

- Compare the coverage limits and exclusions of different policies to determine which one best suits your needs.

- Evaluate the premiums and deductibles associated with each policy to find one that is affordable yet provides adequate protection.

- Review the terms and conditions of the policy, including renewal options, claim procedures, and cancellation policies, to avoid any surprises in the future.

Claims Process for Insurance Policies

When it comes to filing an insurance claim, there are several steps involved in the process. Understanding these steps can help you navigate through the process smoothly, maximize your benefits, and avoid common pitfalls that may delay or deny your claim.

Filing an Insurance Claim

- Contact your insurance company as soon as possible after the incident to report the claim.

- Provide all necessary documentation such as police reports, medical records, and any other relevant information to support your claim.

- Cooperate with the insurance adjuster and provide any additional information they may request to process your claim.

Tips to Expedite the Claims Process

- Keep detailed records of all communication with your insurance company, including dates, times, and names of representatives you speak with.

- Follow up regularly with your insurance company to ensure that your claim is being processed in a timely manner.

- Stay organized and keep all documentation related to your claim in one place for easy access.

Common Pitfalls to Avoid

- Avoid delaying in reporting your claim to the insurance company, as this can lead to complications in processing.

- Do not provide inaccurate or incomplete information to the insurance company, as this can result in claim denial.

- Avoid accepting a settlement offer without fully understanding the terms and ensuring it covers all your losses.