Flood insurance policies are essential for protecting your property in times of disaster. From understanding coverage to navigating the claims process, this comprehensive guide dives into everything you need to know about flood insurance policies.

Basics of Flood Insurance Policies

Flood insurance policies are designed to provide coverage for damages caused by flooding events. This type of insurance typically covers structural damage to your property, as well as personal belongings inside the property.

Coverage Details

- Structural damage to the building, including the foundation, walls, and electrical systems.

- Damages to personal belongings such as furniture, appliances, and clothing.

- Cleanup and restoration costs after a flood event.

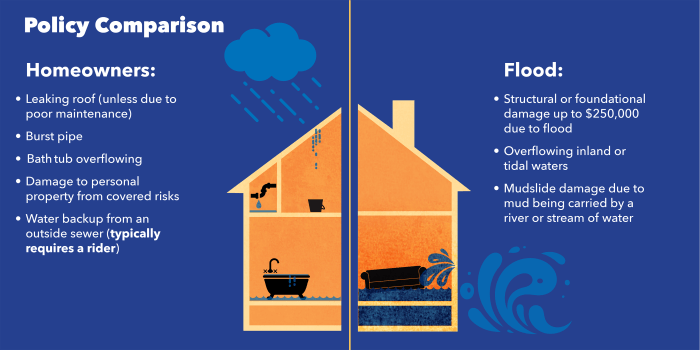

Difference from Other Property Insurance

Flood insurance is different from other types of property insurance, such as homeowners or renters insurance, because it specifically covers damages caused by flooding. Other types of insurance may exclude or have limited coverage for flood-related damages.

Scenarios Requiring Flood Insurance

- Living in a high-risk flood zone where flooding is common.

- Owning a property near a body of water that is prone to overflowing during heavy rains.

- Experiencing frequent severe weather events in your area that could lead to flooding.

Types of Flood Insurance Coverage

When it comes to flood insurance coverage, there are different types available to homeowners. It’s important to understand the options, limits, and exclusions to make an informed decision about protecting your property.

Standard Flood Insurance Policies

Standard flood insurance policies typically cover the building structure and essential systems like electrical and plumbing. However, personal belongings are usually not included in this coverage. It’s essential to review the policy limits and exclusions to know exactly what is protected.

Preferred Risk Policies

Preferred Risk Policies are designed for properties located in low to moderate-risk flood zones. These policies offer lower premiums compared to standard policies, making them an affordable option for homeowners in areas with less flood risk.

Excess Flood Insurance

Excess flood insurance provides additional coverage above the limits of the standard policy. This type of coverage is useful for homeowners with high-value properties or those looking for extra protection beyond the basic policy limits.

Optional Add-Ons or Endorsements

In addition to standard flood insurance coverage, homeowners can opt for optional add-ons or endorsements to enhance their protection. These may include coverage for additional living expenses, replacement cost coverage for personal belongings, or coverage for basements and their contents.

It’s crucial to carefully review the different types of flood insurance coverage available and consider your specific needs and risk factors when choosing the right policy for your property.

Determining Flood Insurance Needs: Flood Insurance Policies

When it comes to determining flood insurance needs, there are several key factors to consider. Understanding these factors can help individuals make informed decisions about whether they need flood insurance coverage.

Factors Influencing the Need for Flood Insurance

- Location: Living in a high-risk flood zone increases the need for flood insurance.

- Property Type: The type of property you own, such as a home or business, can impact your flood insurance needs.

- Financial Risk Tolerance: Assessing your financial ability to recover from flood damage without insurance is crucial in determining your flood insurance needs.

Conducting Flood Risk Assessments

- Flood Maps: Utilize FEMA flood maps to determine the flood risk level of your area.

- Professional Evaluations: Consider hiring a professional to assess your property’s flood risk accurately.

- Online Tools: Use online tools and resources to conduct a preliminary flood risk assessment.

Tips for Self-Assessment

- Check Flood Maps: Review FEMA flood maps to understand the flood risk in your area.

- Assess Property Elevation: Determine if your property is at risk of flooding based on its elevation.

- Consider Past Events: Take into account any history of flooding in your area to gauge your flood risk.

Purchasing Flood Insurance Policies

When it comes to purchasing flood insurance policies, individuals have a few options to consider. Let’s break down the process and key factors to keep in mind.

Where to Buy Flood Insurance

- One of the primary sources to purchase flood insurance is through the National Flood Insurance Program (NFIP), which is managed by the Federal Emergency Management Agency (FEMA).

- Private insurance companies also offer flood insurance policies, providing individuals with additional choices and coverage options.

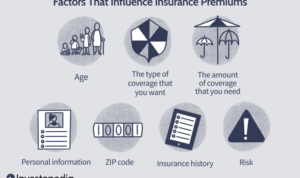

Determining Premiums

- Premiums for flood insurance policies are determined based on various factors, including the flood risk of the property, the coverage amount selected, the property’s location, and the type of policy chosen.

- The NFIP calculates premiums based on the property’s elevation, flood zone, and other risk factors, while private insurers may use different underwriting criteria.

Government-Backed vs. Private Options

- Government-backed flood insurance policies through the NFIP provide standardized coverage and are available to property owners in participating communities.

- Private flood insurance options offer more flexibility in coverage limits and additional benefits, but premiums may vary based on the insurer’s risk assessment.

Making Claims on Flood Insurance

When it comes to making a claim on your flood insurance policy, there are several important steps to keep in mind to ensure a smooth and efficient process. Here’s a breakdown of what you need to do:

Documenting Damage and Filing a Claim Efficiently

- Start by documenting the damage caused by the flood. Take photos and videos of the affected areas, making sure to capture all the details.

- Make a list of all damaged or lost items, including their value and any receipts or proof of purchase you may have.

- Contact your insurance company as soon as possible to file a claim. Provide them with all the necessary documentation and information to support your claim.

- Keep track of all communication with your insurance company, including claim numbers, adjuster’s names, and important dates.

- Follow up regularly with your insurance company to ensure that your claim is being processed in a timely manner.

Common Challenges or Pitfalls When Filing Flood Insurance Claims

- Underestimating the extent of damage or not documenting it properly can lead to delays or denials of your claim.

- Not understanding your policy coverage, exclusions, and limitations can also result in difficulties when filing a claim.

- Waiting too long to file a claim can jeopardize your chances of receiving full compensation for your losses.

- Working with an inexperienced or unresponsive insurance adjuster can further complicate the claims process.