Looking for the hottest car insurance deals around? Well, buckle up because we’re about to take you on a wild ride through the world of car insurance savings. With car insurance deals at the forefront, this paragraph opens a window to an amazing start and intrigue, inviting readers to embark on a storytelling american high school hip style filled with unexpected twists and insights.

From comparing different options to understanding the factors that influence your premiums, we’ve got all the tips and tricks you need to score big on your car insurance deal. So, sit back, relax, and let’s dive into the world of car insurance savings.

Finding the Best Car Insurance Deals

When it comes to finding the best car insurance deals, there are a few key steps to follow. Comparing different options, identifying cost-effective choices, and reading the fine print are crucial parts of the process.

Comparing Different Car Insurance Deals

- Obtain quotes from multiple insurance companies to compare prices.

- Consider the coverage offered by each policy, including liability, collision, and comprehensive.

- Look into additional benefits like roadside assistance or rental car coverage.

Identifying Cost-Effective Options

- Check for any available discounts, such as safe driver or multi-policy discounts.

- Opt for a higher deductible to lower your premium, but make sure you can afford the out-of-pocket cost if needed.

- Review your coverage needs and adjust them accordingly to avoid overpaying for unnecessary coverage.

Reading the Fine Print in Insurance Policies

- Pay attention to exclusions and limitations in the policy that could affect your coverage.

- Understand the claims process and any specific requirements for filing a claim.

- Review the cancellation policy to avoid any surprises if you need to switch insurance providers in the future.

Types of Car Insurance Deals

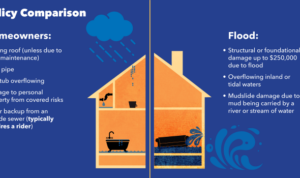

When it comes to car insurance deals, there are several types available to choose from, each offering different levels of coverage and protection. It’s essential to understand the differences between these options to make an informed decision based on your needs and budget.

Comprehensive Insurance

Comprehensive insurance is the most extensive coverage option available. It provides protection for your vehicle against a wide range of risks, including theft, vandalism, natural disasters, and accidents. In addition to covering damages to your car, comprehensive insurance also includes coverage for third-party liabilities, medical expenses, and personal injury protection.

Third-Party Insurance

On the other hand, third-party insurance offers the most basic level of coverage. It only covers damages and injuries caused to other people and their property in an accident where you are at fault. Third-party insurance does not cover any damages to your vehicle or personal injuries, so it is essential to consider this when choosing your insurance plan.

Add-Ons and Extras

In addition to the standard coverage options, many insurance companies offer add-ons or extras that can enhance your car insurance deal. These add-ons may include roadside assistance, rental car coverage, gap insurance, and coverage for custom parts and accessories. While these extras may come at an additional cost, they can provide valuable benefits and peace of mind in case of an emergency or accident.

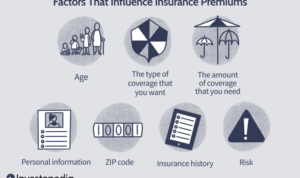

Factors Influencing Car Insurance Deals

When it comes to car insurance deals, several factors play a crucial role in determining the premiums you pay and the coverage you receive. Factors such as age, driving history, location, type of vehicle, and bundling policies can significantly impact the cost of your car insurance deals.

Age, Driving History, and Location

- Your age can affect your car insurance premiums, with younger drivers typically facing higher rates due to their lack of experience on the road.

- Driving history is another key factor, as a clean record with no accidents or traffic violations can lead to lower insurance costs.

- Where you live also plays a role, as urban areas with higher rates of accidents and theft may result in higher premiums compared to rural areas.

Type of Vehicle

- The type of vehicle you drive can impact your insurance costs, with factors such as the make and model, safety features, and repair costs influencing premiums.

- Luxury vehicles or sports cars may come with higher insurance rates due to their increased risk of theft or accidents.

Bundling Policies

- Bundling your car insurance with other policies like home or life insurance can often lead to better deals and discounts from insurance providers.

- Insurance companies may offer lower rates for customers who choose to bundle multiple policies, making it a cost-effective option for coverage.

Comparing Car Insurance Deals Online

When it comes to finding the best car insurance deals, the internet can be a powerful tool. Online platforms offer a convenient way to compare various insurance options, allowing you to quickly and easily find the coverage that suits your needs and budget.

Using Online Tools to Compare Car Insurance Deals

- Start by visiting reputable insurance comparison websites that allow you to input your information and receive quotes from multiple providers.

- Enter accurate details about your vehicle, driving history, and coverage preferences to ensure you receive the most relevant quotes.

- Compare the coverage options, premiums, deductibles, and additional features offered by different insurance companies to determine the best deal for you.

Advantages and Disadvantages of Purchasing Car Insurance Online, Car insurance deals

- Advantages:

- Convenience: You can compare multiple quotes from the comfort of your home without the need to visit different insurance agencies.

- Cost-effective: Online insurance deals often come with discounts and special offers that may not be available through traditional channels.

- Transparency: Online platforms provide detailed information about each policy, making it easier to understand the coverage and terms.

- Disadvantages:

- Lack of personal interaction: Some people prefer dealing with an agent face-to-face for a more personalized experience.

- Potential for misinformation: Without speaking directly to an agent, there is a risk of misunderstanding policy details or requirements.

- Security concerns: Sharing personal information online may raise security and privacy issues for some individuals.

Key Factors to Consider When Using Online Platforms to Find the Best Deals

- Compare prices but also consider the coverage and customer service reputation of the insurance companies.

- Check for any hidden fees, exclusions, or restrictions that may impact your coverage.

- Read reviews and ratings from other customers to gauge the overall satisfaction and reliability of the insurance provider.