Get ready to dive into the exciting realm of crypto staking rewards, where earning passive income meets the world of digital currencies. From understanding the basics to exploring the potential risks, this guide will take you on a journey through the ins and outs of crypto staking rewards.

Overview of Crypto Staking Rewards

Crypto staking rewards are incentives given to holders of certain cryptocurrencies for participating in the validation of transactions on a blockchain network. By staking their coins, users help secure the network and, in return, receive rewards in the form of additional coins.

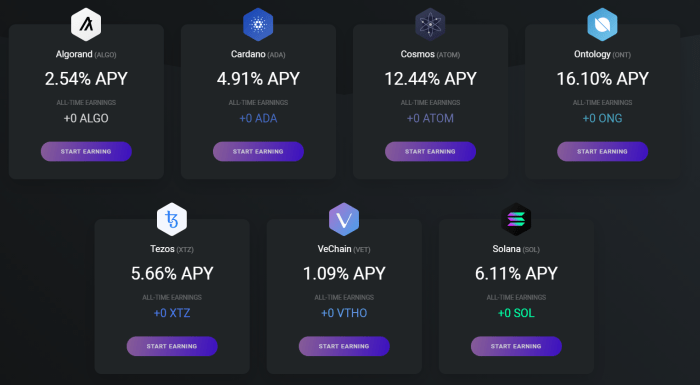

Cryptocurrencies Offering Staking Rewards

- Ethereum (ETH): Ethereum allows users to stake their coins in the upcoming Ethereum 2.0 upgrade, earning rewards for helping secure the network.

- Cardano (ADA): Cardano offers staking rewards to ADA holders who delegate their coins to a stake pool, contributing to the network’s security and decentralization.

- Tezos (XTZ): Tezos utilizes a delegated proof-of-stake consensus mechanism, where users can stake their XTZ tokens and receive rewards for participating in block validation.

Benefits of Earning Staking Rewards

- Passive Income: Staking rewards provide a passive income stream for cryptocurrency holders without the need for active trading.

- Network Security: By staking their coins, users help secure the blockchain network, making it more resilient to attacks.

- Token Appreciation: Earning staking rewards can contribute to the overall value appreciation of the cryptocurrency held by investors.

How Crypto Staking Works

In the world of cryptocurrency, staking is a process where users hold funds in a cryptocurrency wallet to support the operations of a blockchain network and in return, they receive rewards.

The Role of Validators

Validators play a crucial role in the staking process by verifying transactions and creating new blocks on the blockchain. They are responsible for securing the network and ensuring its smooth operation.

- Validators are chosen based on the number of coins they hold and are required to lock up a certain amount of cryptocurrency as collateral.

- They are incentivized to act honestly and validate transactions accurately to earn staking rewards.

- If a validator behaves maliciously or dishonestly, they risk losing their staked coins as a penalty.

Proof of Stake vs Proof of Work

In the world of cryptocurrencies, there are two main consensus mechanisms used to validate transactions and secure the network: Proof of Stake (PoS) and Proof of Work (PoW).

- Proof of Stake (PoS): In PoS, validators are chosen to create new blocks based on the number of coins they hold and are willing to stake. This method is more energy-efficient compared to PoW.

- Proof of Work (PoW): PoW requires miners to solve complex mathematical puzzles to validate transactions and create new blocks. This process is energy-intensive and requires powerful hardware.

Factors Influencing Staking Rewards

When it comes to crypto staking rewards, there are several key factors that can influence the amount you earn. Understanding these factors is crucial for maximizing your rewards and making informed decisions.

Duration of Staking, Crypto staking rewards

The duration of staking plays a significant role in determining the rewards you receive. In general, the longer you stake your coins, the higher the rewards you can earn. This is because longer staking periods often come with higher interest rates or rewards as an incentive for locking up your coins for an extended period. It is essential to consider your investment goals and risk tolerance when deciding on the duration of your staking.

Staking Pool Size

The size of the staking pool also affects the rewards you can earn. A larger staking pool typically means that rewards are distributed among more participants, resulting in smaller individual rewards. On the other hand, a smaller staking pool may offer higher rewards per participant since there are fewer people to share the rewards with. It is essential to consider the size of the staking pool when choosing where to stake your coins to maximize your rewards.

Risks Associated with Crypto Staking Rewards

When engaging in crypto staking for rewards, there are certain risks that participants should be aware of to make informed decisions.

Market Volatility Impact

- Market volatility can significantly affect staking rewards as the value of the staked cryptocurrency may fluctuate.

- During periods of high volatility, stakers may experience a decrease in the value of their rewards, impacting overall profitability.

- It is essential for stakers to monitor market conditions closely and be prepared for potential fluctuations in rewards.

Mitigating Risks

- Diversification of staking assets can help reduce the impact of market volatility on rewards by spreading risk across different cryptocurrencies.

- Choosing reputable staking platforms with a proven track record of security and reliability can minimize the risk of potential losses.

- Regularly reassessing staking strategies and adjusting them based on market conditions can help stakers adapt to changing circumstances and mitigate risks effectively.