Diving into the insurance claims process, buckle up as we explore the ins and outs of filing claims, understanding different types, and the factors that influence approvals. Get ready for a wild ride through the world of insurance!

Overview of Insurance Claims Process

When it comes to dealing with insurance claims, the process can be a bit complex but it’s crucial for both insurance companies and policyholders. Let’s break it down into key steps and see why a smooth and efficient process is so important.

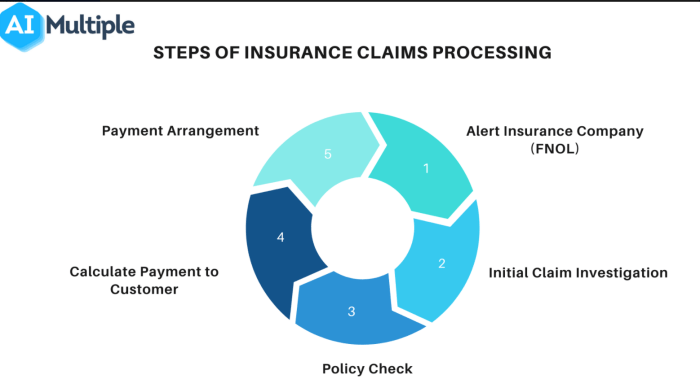

Key Steps in Filing an Insurance Claim

- Report the Incident: The first step is to report the incident to your insurance company as soon as possible. This could be a car accident, property damage, or any other covered event.

- Documentation: Gather all the necessary documentation to support your claim, such as police reports, photos, and witness statements.

- Submit Claim: Fill out the claim form provided by your insurance company and submit it along with the required documents.

- Assessment: An adjuster will assess the damage and determine the coverage and payout amount based on your policy.

- Resolution: Once the claim is approved, you will receive the payout to cover the damages or losses incurred.

Importance of a Smooth Claims Process, Insurance claims process

Having a smooth and efficient claims process is beneficial for both insurance companies and policyholders. For insurance companies, it helps in maintaining customer satisfaction, reducing fraudulent claims, and streamlining operations. On the other hand, policyholders benefit from faster claim settlements, financial support in times of need, and overall peace of mind knowing they are protected.

Types of Insurance Claims

When it comes to insurance claims, there are several different types depending on the nature of the loss or damage. Each type of claim has specific requirements and documentation needed for processing. Let’s take a closer look at the common types of insurance claims and the timelines associated with them.

Auto Insurance Claims

Auto insurance claims are filed when a vehicle is involved in an accident or sustains damage. To process an auto insurance claim, you typically need to provide details of the accident, photos of the damage, a copy of the police report (if applicable), and any other relevant documentation. The processing timeline for auto insurance claims can vary depending on the extent of the damage and the complexity of the case.

Health Insurance Claims

Health insurance claims are submitted when seeking reimbursement for medical expenses such as doctor’s visits, hospital stays, or prescription medications. To file a health insurance claim, you usually need to provide copies of medical bills, receipts, and a claim form from your insurance provider. The processing timeline for health insurance claims can range from a few days to several weeks, depending on the insurance company’s policies.

Property Insurance Claims

Property insurance claims are made when there is damage to your home or personal belongings due to events like fires, theft, or natural disasters. When filing a property insurance claim, you will need to provide an inventory of the damaged items, photos of the damage, a copy of the police report (if applicable), and any repair estimates. The processing timeline for property insurance claims can vary based on the extent of the damage and the availability of adjusters.

Factors Influencing Claim Approval

When it comes to getting your insurance claim approved, there are several key factors that insurance companies take into consideration. Understanding these factors can help you navigate the claims process more effectively.

Insurance companies assess the validity of a claim by looking at various factors such as the policy coverage, the cause of the damage or loss, the documentation provided, and the timeliness of the claim submission. They need to ensure that the claim meets all the requirements Artikeld in the policy to approve it.

Role of Adjusters

Adjusters play a crucial role in investigating and processing insurance claims. They are responsible for assessing the extent of the damage, determining the cause of the loss, and verifying the details provided in the claim. Adjusters work on behalf of the insurance company to ensure that the claim is valid and accurate.

- Adjusters conduct on-site inspections to evaluate the damage and gather evidence.

- They review the policy coverage to determine the extent of the insurance company’s liability.

- Adjusters communicate with the policyholder to obtain additional information or documentation.

Adjusters play a critical role in ensuring that insurance claims are processed fairly and accurately.

Common Reasons for Claim Denials

There are several common reasons why insurance claims may be denied by the insurance company. Understanding these reasons can help you avoid potential claim denials in the future.

- Policy exclusions: Claims that fall under policy exclusions are typically denied. It’s important to review your policy to understand what is covered and what is not.

- Delayed reporting: Failing to report a claim in a timely manner can result in a denial. It’s crucial to notify your insurance company as soon as possible after an incident.

- Lack of documentation: Insufficient or inaccurate documentation can lead to claim denials. Make sure to provide all necessary documentation to support your claim.

Technology in Claims Processing: Insurance Claims Process

In today’s digital age, technology plays a crucial role in improving the efficiency of insurance claims processing. By leveraging advancements such as Artificial Intelligence (AI) and automation, insurance companies are able to streamline the claims management process, making it faster and more accurate.

AI and Automation in Claims Processing

AI-powered systems are being used to analyze large volumes of data to detect fraud, assess risk, and process claims faster. Automation tools help in reducing manual tasks, such as data entry and document processing, allowing claims adjusters to focus on more complex cases.

- One example of software used in claims processing is ClaimCenter by Guidewire. This software automates the end-to-end claims management process, from intake to settlement, improving operational efficiency and customer satisfaction.

- Another example is IBM Watson, which uses AI to analyze unstructured data from various sources, enabling insurers to make more informed decisions during the claims evaluation process.

By implementing AI and automation in claims processing, insurers can reduce processing times, improve accuracy, and enhance customer experience.

Benefits and Challenges of Implementing Technology

- Benefits:

- Increased efficiency and speed in claims processing.

- Enhanced fraud detection capabilities.

- Improved customer service through faster claim settlements.

- Challenges:

- Initial investment costs for implementing new technology.

- Data security and privacy concerns with the use of AI and automation.

- Resistance to change from employees accustomed to traditional claims processing methods.