When it comes to insurance premium calculation, we dive into a world where costs are carefully calculated based on various factors. Get ready to uncover the secrets behind determining your insurance premiums with style and flair.

From personal details to external influences, understanding how these elements come together to shape your premium is crucial in navigating the insurance landscape.

Introduction to Insurance Premium Calculation

Insurance premium calculation is the process through which insurance companies determine the amount of money a policyholder needs to pay for coverage. This calculation is based on various factors that assess the risk associated with insuring an individual or entity.

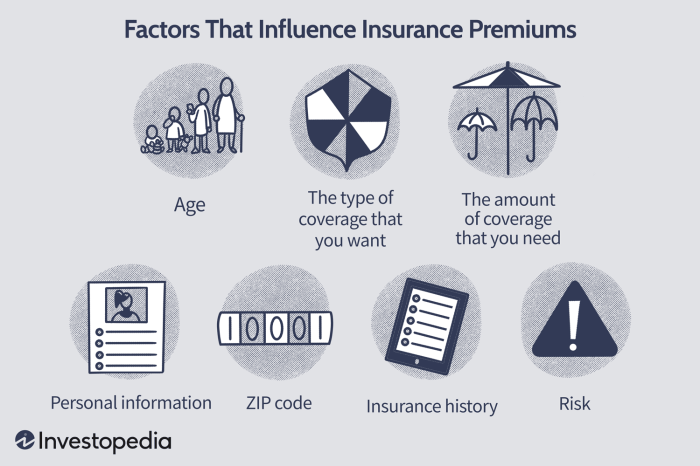

Factors Influencing Insurance Premium Calculations

- Age and demographics of the policyholder

- Type of coverage and policy limits

- Claims history and previous insurance coverage

- Location and environmental factors

- Health status and lifestyle choices

Importance of Accurate Premium Calculations

Accurate premium calculations are crucial for insurance companies to maintain financial stability and offer competitive rates to policyholders. Without precise calculations, insurers risk underpricing or overpricing policies, which can lead to financial losses or dissatisfied customers.

Role of Actuarial Science in Determining Insurance Premiums

Actuarial science plays a key role in determining insurance premiums by using statistical data and mathematical models to assess risk and predict future losses. Actuaries analyze various factors to set appropriate premium rates that align with the insurer’s financial objectives and the policyholder’s risk profile.

Factors Affecting Insurance Premium Calculation

When it comes to calculating insurance premiums, there are several factors that come into play. These factors can impact how much you pay for coverage and the type of coverage you can get.

Personal Factors

- Age: Younger individuals typically pay lower premiums as they are considered lower risk. Older individuals may face higher premiums due to increased likelihood of health issues.

- Gender: In some cases, gender can affect insurance premiums. For example, women may pay more for life insurance due to longer life expectancy.

- Health History: Pre-existing conditions or a history of health issues can increase premiums as insurers perceive higher risk.

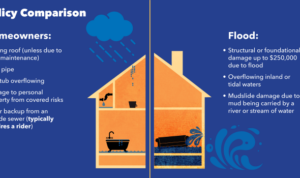

Type of Insurance Coverage and Policy Limits

- The type of insurance coverage you choose will directly impact your premium costs. Comprehensive coverage will generally cost more than basic coverage.

- Policy limits determine the maximum amount the insurance company will pay out for a claim. Higher limits can lead to higher premiums.

Location and External Factors

- Location: Where you live can affect your insurance premiums. Areas prone to natural disasters or high crime rates may result in higher premiums.

- External Factors: External factors such as crime rate, weather conditions, or proximity to a fire station can impact insurance premiums.

Deductibles and Coverage Options

- Deductibles: Choosing a higher deductible can lower your premiums, but you’ll pay more out of pocket in the event of a claim.

- Coverage Options: Adding additional coverage options, such as rental car coverage or roadside assistance, can increase your premiums.

Methods Used in Insurance Premium Calculation

Insurance companies use various methods to calculate insurance premiums based on factors like underwriting, predictive modeling, and data analytics.

Role of Underwriting in Determining Insurance Premiums

Underwriting plays a crucial role in determining insurance premiums by assessing the risk associated with insuring a particular individual or entity. This process involves evaluating various factors such as age, health condition, occupation, and lifestyle to determine the likelihood of filing a claim. The higher the risk, the higher the premium.

Manual vs. Automated Premium Calculations

Manual premium calculations involve human underwriters assessing risks and determining premiums based on their expertise and experience. On the other hand, automated premium calculations use algorithms and software to analyze data and calculate premiums quickly and accurately. While manual calculations may be more personalized, automated calculations are efficient and less prone to errors.

Use of Predictive Modeling and Risk Assessment

Insurance companies use predictive modeling and risk assessment to forecast future claims and determine appropriate premiums. By analyzing historical data and trends, insurers can predict the probability of claims and adjust premiums accordingly. This helps in pricing policies accurately and managing risks effectively.

Data Analytics and Technology in Premium Calculation

Advancements in data analytics and technology have transformed premium calculation methods by enabling insurers to analyze vast amounts of data quickly and efficiently. By leveraging technologies like artificial intelligence and machine learning, insurers can enhance risk assessment, personalize premiums, and improve overall accuracy in pricing policies. This data-driven approach helps insurers stay competitive and better serve their customers.

Challenges and Considerations in Insurance Premium Calculation

Insurance premium calculation is a complex process that involves various challenges and considerations for insurance companies. It is crucial to accurately determine premiums to ensure financial stability and fair pricing for both the insurer and the insured. Let’s delve into the common challenges and important factors that play a role in premium calculations.

Common Challenges Faced by Insurance Companies

- 1. Data Accuracy: One of the major challenges faced by insurance companies is ensuring the accuracy of the data used in premium calculations. Inaccurate or incomplete information can lead to incorrect premium assessments.

- 2. Changing Risk Factors: Insurance companies must constantly monitor and assess changing risk factors that can impact premium calculations. Factors such as market conditions, regulatory changes, and new technologies can affect the level of risk associated with policies.

- 3. Fraud Prevention: Detecting and preventing insurance fraud is a significant challenge for companies as fraudulent claims can impact premium calculations and overall profitability.

Regulatory Considerations and Compliance Requirements

- Insurance companies must adhere to strict regulatory guidelines and compliance requirements set forth by governing bodies. These regulations dictate how premiums are calculated, ensuring fairness, transparency, and consumer protection.

- Regulatory considerations also include the use of actuarial methods, risk assessment tools, and pricing models that comply with industry standards and best practices.

Affordability for Customers vs. Profitability for Insurance Companies

- Insurance companies face the challenge of striking a balance between offering affordable premiums to attract customers and maintaining profitability to sustain their operations. Pricing policies too high may drive away customers, while pricing too low may result in financial losses.

- Companies must consider market competition, consumer demand, and risk exposure when determining premium rates to ensure a healthy balance between affordability and profitability.

Ethical Considerations in Setting Insurance Premiums, Insurance premium calculation

- Setting insurance premiums raises ethical considerations regarding fairness, transparency, and equity. Insurance companies must ensure that premium rates are based on accurate risk assessments and do not discriminate against certain individuals or groups.

- Ethical considerations also extend to the handling of claims, customer service, and overall business practices to maintain trust and integrity within the industry.