Long-Term Care Insurance – buckle up for a ride through the ins and outs of this vital coverage option. From defining its purpose to exploring different policy types, get ready to dive deep into the world of long-term care insurance.

What is Long-Term Care Insurance?

Long-term care insurance is a type of coverage that helps individuals pay for services required when they are unable to perform basic activities of daily living due to chronic illness, disability, or aging. The purpose of long-term care insurance is to provide financial assistance for long-term care services, such as nursing home care, assisted living facilities, and home healthcare. It helps protect individuals from depleting their savings and assets to cover the high costs of long-term care.

Importance of Having Long-Term Care Insurance

Long-term care insurance is essential as it ensures that individuals can receive the necessary care without draining their financial resources. Without this coverage, the cost of long-term care services can be exorbitant and could lead to financial hardship for individuals and their families. Having long-term care insurance provides peace of mind by offering a safety net in case long-term care services are needed in the future.

Typical Coverage Included in Long-Term Care Insurance Policies

- Coverage for nursing home care: This includes the cost of staying in a nursing home facility for individuals who require 24-hour skilled nursing care.

- Assisted living facility coverage: Long-term care insurance may cover the expenses associated with living in an assisted living facility for individuals who need help with daily activities.

- Home healthcare services: Coverage for home healthcare services, such as nursing care, physical therapy, and assistance with activities of daily living, may be included in long-term care insurance policies.

- Respite care coverage: Some policies offer coverage for respite care, which provides temporary relief to primary caregivers by allowing the individual to stay in a care facility for a short period.

Types of Long-Term Care Insurance Policies

When it comes to long-term care insurance, there are different types of policies available to meet varying needs and preferences.

Traditional Long-Term Care Insurance

Traditional long-term care insurance policies provide coverage for long-term care services such as nursing home care, assisted living facilities, and home health care. Policyholders pay premiums in exchange for coverage if they need long-term care in the future. Benefits are usually paid out on a reimbursement basis.

- Examples of companies offering traditional long-term care insurance include Genworth Financial, Mutual of Omaha, and Transamerica.

- These policies typically have a waiting period before benefits kick in, and premiums may increase over time.

Hybrid Long-Term Care Insurance

Hybrid policies combine long-term care coverage with life insurance or annuities. Policyholders can access the long-term care benefit if needed or leave a death benefit to their beneficiaries if they do not require long-term care. These policies provide more flexibility and can address concerns about paying for care versus leaving an inheritance.

- Examples of companies offering hybrid long-term care insurance include State Farm, Nationwide, and New York Life.

- Hybrid policies typically have a single premium or limited premium payment options, and they may offer a return of premium feature.

Eligibility and Cost Factors

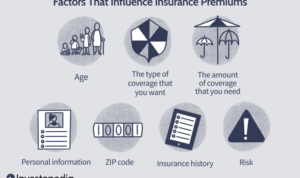

To be eligible for long-term care insurance, individuals usually need to meet certain criteria such as being in good health at the time of application, not already needing long-term care services, and being within a certain age range. The factors that determine eligibility can vary depending on the insurance provider.

Age and health status play a significant role in determining the cost of long-term care insurance. Generally, the younger and healthier you are when you purchase a policy, the lower your premiums will be. This is because younger individuals are less likely to need long-term care services in the near future, resulting in lower risk for the insurance company.

Impact of Age and Health Status

- Younger individuals typically pay lower premiums for long-term care insurance compared to older individuals.

- Individuals with pre-existing health conditions may face higher premiums or even be denied coverage.

- Regular health check-ups and maintaining a healthy lifestyle can help in securing more affordable long-term care insurance.

Inflation Protection in Policies

Inflation protection is an important feature in long-term care insurance policies that helps ensure coverage keeps pace with rising costs of long-term care services over time. Without inflation protection, the benefits provided by the policy may not be enough to cover the actual cost of care when it is needed.

- There are different types of inflation protection options available, such as automatic compound inflation protection, simple inflation protection, and guaranteed purchase options.

- Having inflation protection can increase the initial cost of the policy but can be crucial in ensuring adequate coverage in the future.

Benefits and Limitations: Long-term Care Insurance

Long-term care insurance can provide a sense of security and financial protection for individuals who may require extended care as they age. However, it is important to understand both the benefits and limitations of these policies before making a decision.

Benefits of Long-Term Care Insurance

- Financial Protection: Long-term care insurance can help cover the high costs of long-term care services, such as nursing home care, assisted living facilities, and in-home care.

- Choice and Control: Having long-term care insurance gives individuals the flexibility to choose the type of care they receive and where they receive it.

- Peace of Mind: Knowing that long-term care expenses are covered can provide peace of mind for both the policyholder and their loved ones.

Limitations of Long-Term Care Insurance

- Exclusions: Some long-term care insurance policies may have exclusions for pre-existing conditions or specific types of care.

- Cost: Premiums for long-term care insurance can be expensive, and not everyone may be able to afford them.

- Coverage Limits: Most policies have limits on the amount of coverage provided, which may not fully cover all long-term care expenses.

Real-Life Scenarios

Case 1: Sarah, a 65-year-old retiree, purchased long-term care insurance years ago. When she was diagnosed with a chronic illness requiring extensive care, her policy covered the costs of in-home nursing care, providing her with the support she needed without depleting her savings.

Case 2: John, a 70-year-old without long-term care insurance, needed nursing home care after a fall. Without insurance, he had to rely on his savings and family members to cover the high costs, causing financial strain and limited care options.